Money mules: 14% of young people willing to lend their bank card in exchange for money

1 December 2021 - 9 min Reading time

Criminals use money mules to get their hands on illegally obtained money (often through phishing). The criminals promise money mules that they can earn quick and easy money, in exchange for lending them their bank account and/or bank card and PIN code.

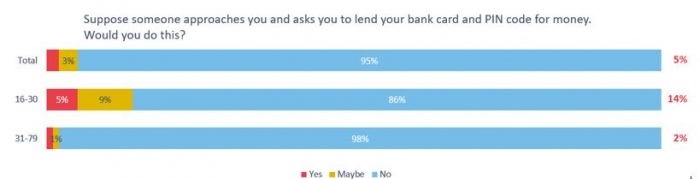

- oung people are very susceptible to becoming money mules: research conducted by Febelfin in collaboration with IndiVille shows that no less than 14% of young people (between the ages of 16 and 30) would lend their bank card and PIN number in exchange for money. In 2019 this was about 10%.

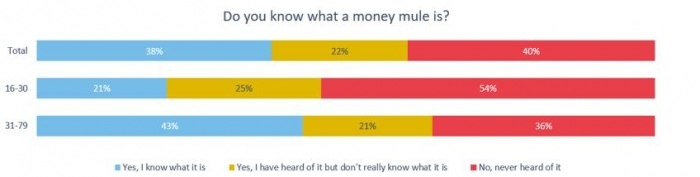

- 79% of young people do not know what money mules are. Also 57% of the adults (30-79 years) have not or hardly heard of money mules.

- The phenomenon is expanding: in addition to bank cards and PIN codes, fraudsters are increasingly asking for (a copy of) identity documents, mobile phone numbers and address details.

- As a money mule, you are helping to launder money, which is illegal.

- Febelfin and the Antwerp police warn young people and their surroundings about this phenomenon via digital awareness brochures, aimed at young people and their supervisors. These brochures are distributed in collaboration with Febelfin's partner network, in the schools network and in the youth work sector.

- Febelfin launches educational material that sheds light on the money mules phenomenon in collaboration with ED TV, an online learning platform for young people and teachers that uses videos to make difficult subjects easier to discuss.

What are money mules?

A money mule allows their bank account and/or bank card and PIN number to be used (either consciously or unconsciously) by criminals to launder money. Criminals promise money mules that they can earn money quickly in exchange for their bank card and PIN code. They need these in order to deposit illegally obtained money (often through phishing), channel it or withdraw cash immediately. In this way they themselves remain unknown. A money mule does the dirty work, but is left behind with the misery. Being a money mule is punishable because they help to launder money.

14% of young people willing to become a money mule

A Febelfin survey, conducted in collaboration with the research bureau IndiVille, shows that young people in particular are very susceptible to becoming a money mule. 14% would consider giving their bank card and PIN number in exchange for money.

IndiVille survey March 2021, on a representative sample of the Belgian population n: 2045 NL/FR surveys, age 16-79.

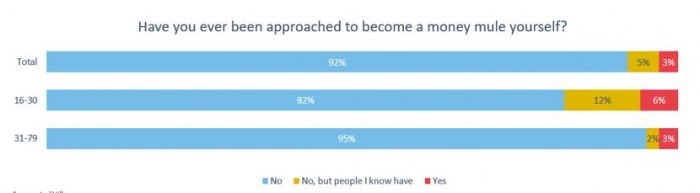

In the same study, 3% of the population indicated that they had ever been approached with the question of becoming a money mule. Among young people, this figure is much higher: 6% have been approached themselves and another 12% know someone who has been approached.

Worryingly, only 38% of the total population knows what a money mule is. An improvement on 2019 when the figure was 22%, but it still remains low. Striking: among young people, only 21% know what a money mule is. This means that 8 in 10 young people do not know what a money mule is.

It’s not just bank accounts and PIN codes

These days, criminals are also increasingly asking for other details from money mules, such as identity cards (or a copy), mobile phone numbers and address details. Because this info too can make it easier for criminals to commit fraud.

"In our investigations, we find that young people are increasingly having their identities misused, whether intentionally or not. We regularly see phishing incidents where fraudulent messages are sent using a mobile phone number that appears to be in the name of a minor. In this way the criminals stay out of harm's way and the police and judicial authorities only find out about these young people. We also see that young people make their address available to criminals in order to have postal packages delivered. Criminals buy expensive goods with stolen money via web shops. They have their orders delivered to the address of these youngsters so that they themselves remain under the radar. The ultimate recruitment channels for this type of practice are various Telegram and Snapchat groups," says Stijn De Ridder, head of the Antwerp police zone.

Becoming a money mule = laundering money

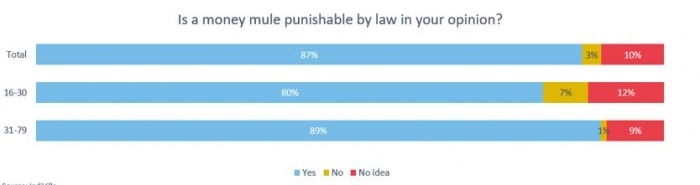

When asked whether becoming a money mule is illegal and therefore punishable, 10% of adults believe it is not. And as many as 19% of young people have no idea or think it is not punishable.

But becoming a money mule is anything but innocent. A money mule (unintentionally) cooperates in money laundering and fraud, which are punishable practices. Via the bank account of the money mule, the phisher can get illegally obtained money back into the legal circuit. The consequences are far from negligible: the money mule can be held liable and can be prosecuted, risking large judicial and tax fines. The bank may also refuse to grant money mules a bank account, bank card and/or loan. Moreover, the money mule risks having their account plundered by the criminals.

Febelfin and partners raise awareness

In order to warn young people and their environment, Febelfin has been highlighting the phenomenon of money mules for the third year in a row. In collaboration with a number of partners, such as the Antwerp police zone, Jes, Formaat, Kras Jeugdwerk and SAAMO, Febelfin produced awareness-raising material for young people and their environment, to prevent money mule fraud.

SAAMO Antwerp: "Wanting to earn easy money by being a money mule only causes problems. Yet in practice we notice that many young people are tempted. That is why these brochures are so necessary: they explain exactly what money mules do and why it is dangerous. We really need to make sure that young people understand this and these brochures will help to do that."

Brochures for youngsters and parents

Febelfin has produced information brochures on this theme to inform young people and their supervisors. In it, you learn what the phenomenon is exactly, how you can recognise it and how you can prevent it. Do you know someone who has become a money mule? Then read about what you can do to help. The brochures will be distributed in collaboration with Febelfin's partners in school networks and in the youth work sector. The brochures can be found below and are suitable for printing or further distribution:

The ‘money mule’ campaign posters are also available for free and are suitable for printing in an A3 format:

Educational material for teachers

Febelfin also collaborated with ED TV, a platform for young people and teachers that uses videos to make difficult subjects easier to discuss. ED TV made online episodes with accompanying school factsheets that shed light on the money mule phenomenon and that get the discussion going. What is nice about this material is that it is in line with the final attainment levels in education and fits in with the need to include financial education in the classroom.

On the French-speaking side, content is being distributed in collaboration with the organisation Enseignons.be, Belgium's leading platform for educational material and online courses, which is very popular with teachers and lecturers.